The easy way to pay off your home loan early

You could save thousands in interest and pay off your loan earlier by changing your repayment frequency from monthly to bi-monthly.

Changing your repayments from monthly to bi-monthly can make a massive difference in the amount of interest you pay and time spent paying your loan off.

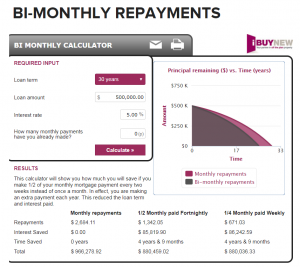

Jack and Jill are looking to buy their first home in Surfers Paradise, Gold Coast, QLD. They have decided to take out a loan of $500,000 charged at 5.00% over 30 years. They have worked out that their monthly repayments would be $2,684.11 with a total loan cost of $966,279.00.

After analysing their budget and speaking with us, they decided that they could reduce the amount of interest payable on their loan by making their repayments more frequently. By rearranging their personal finances, they discovered that they can afford to make their repayments on a bi-monthly basis.

Therefore, by cutting their monthly repayments in half and making them every fortnight, they calculated that their bi-monthly repayment would be $1,342.05 with a total annual repayment of $880,459.02. By committing to their repayments more regularly, they would save a total of $85,819.90 in interest, and reduce their loan period by 4 years and 9 months.

Bi-Monthly Calculator

Disclaimer: Whilst every effort has been made to ensure the accuracy of this calculator, the results should be used as an indication only. They are neither a quote nor a pre-qualification for a home loan.

How does it work?

Typically loan repayments are calculated monthly and depending on your lender, you should have the choice of making your repayments either fortnightly or monthly. When you make your repayments fortnightly, you are simply paying the equivalent of half your monthly repayment.

Paying fortnightly means you can squeeze in one extra monthly repayment each year. This additional amount comes directly off your loan principal and reduces the amount on which future interest will be calculated. As there is less interest, more of the repayment will go towards paying off the principal which means that your mortgage is paid off sooner.

Making your repayments fortnightly is easy to manage if you can schedule your repayments with your payment cycle so that you can save thousands in interest over the life of your loan.

Monthly VS Fortnightly Repayments

When looking at different home loan products, it’s worth considering how often you can make your repayments.

The above bi-monthly calculator illustrates how much you can save if you make fortnightly repayments instead of monthly repayments. In effect, the calculator highlights that by making fortnightly repayments, you can make one extra repayment every year which reduces the loan term and total interest paid.

Contact us to find out how much you could save by making your repayments fortnightly, rather than monthly.

Important: Understand how your lender calculates repayments

Not every lender calculates repayments this way, so you will need to confirm your lender’s repayment terms to see whether fortnightly repayments will help you fast-track your way out of debt.

See us to discuss switching your home loan if your current lender does not allow bi-monthly repayments.

Call Toll Free: 1300 001 370 or visit our Website: www.assetfinance.com.au